Monthly Cotton Economic Letter (2017.11)

Dec 14, 2017 | by Flora

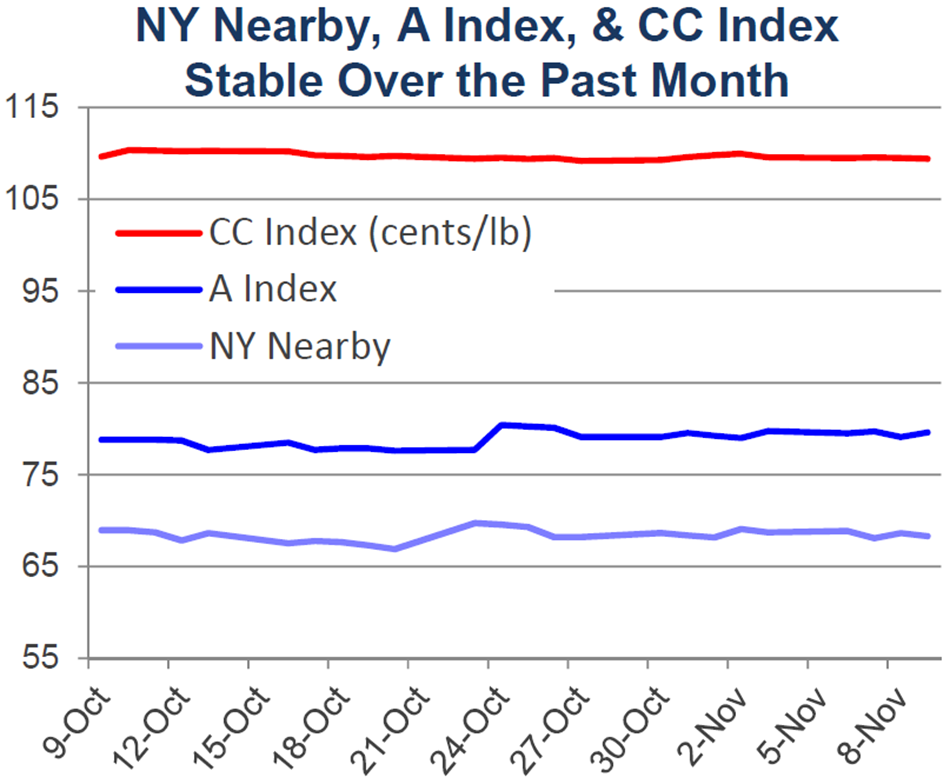

Recent price movement

Most benchmark prices were unchanged over the past month. Only Pakistani prices had any notable movement, increasing slightly.

l Values for the NY December contract were range-bound over the past month, holding to levels between 66 and 70 cents/lb. Nonetheless, prices migrated towards the lower end of that range in mid-October and then shifted towards the middle of the range at the end of the month. The latest values have been near 68 cents/lb.

l The A Index also was range-bound, generally trading between 77 and 80 cents/lb.

l The China Cotton (CC) Index held to levels near 110 cents/lb in international terms. In domestic terms, the CC Index consistently traded near 16,000 RMB/ton.

l Indian prices for the Shankar-6 variety were relatively stable near 75 cents/lb over the past month. In domestic terms, Indian prices were consistently near 38,000 INR/candy.

l Pakistani prices rose slightly between early October and early November, increasing from 69 to 72 cents/lb. In domestic terms, values climbed from 6,000 to 6,300 PKR/maund.

Supply, demand, & trade

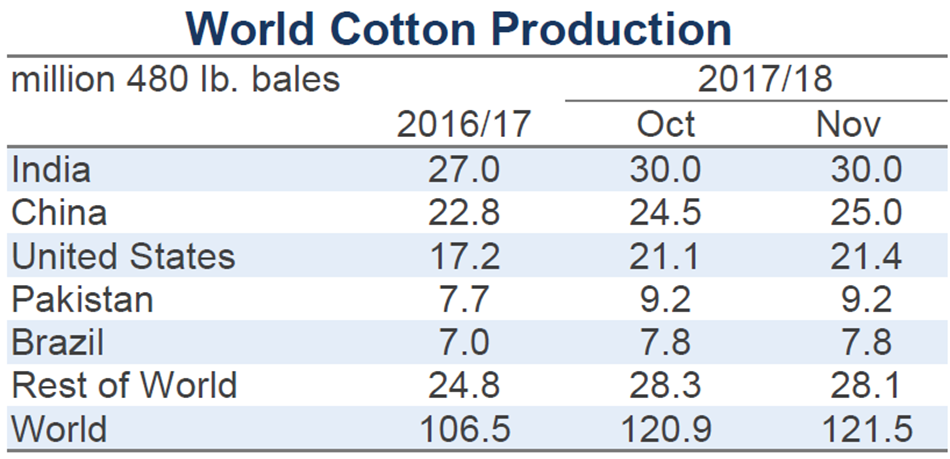

This month’s USDA report featured higher production and consumptions forecasts. The global harvest figure was increased 596,000 bales, from 120.9 to 121.5 million. Global mill-use was increased 1.2 million bales, from 118.0 to 119.3 million.

The larger addition to mill-use suggests a slight decrease to the projection for world ending socks. However, historical revisions to estimates for the past ten years (concentrated on Argentina, Bangladesh, Uzbekistan, and several African countries) resulted in a 903,000 bale reduction to 2017/18 beginning stocks. This reduction in beginning stocks helped to pull the forecast for 2017/18 world ending stocks 1.5 million bales lower than it was last month (from 92.4 to 90.9 million).

The projection for ending stocks in China was increased 200,000 bales, from 39.5 to 39.7 million. The projection for ending stocks in the world-less-China was decreased 1.7 million bales (from 52.9 to 51.2 million). However, the current estimate still predicts the largest ever volume of ending stocks for the world-less-China in 2017/18, easily exceeding the previous record of 44.2 million bales set in 2014/15 (15% higher).

The largest country-level revisions to production figures included a 262,000 bale increase to the harvest estimate for the U.S. (from 21.2 to 21.6 million), as well as changes in expectations for China (+500,000, from 38.5 to 39.0 million), Australia (-200,000, from 5.0 to 4.8 million), and Chad (-120,000, from 270,000 to 150,000).

The largest country-level revisions for mill-use included those for Uzbekistan (+550,000, from 1.8 to 2.3 million), China (+500,000 bales, from 38.5 to 39.0 million), Bangladesh (+300,000, from 6.9 to 7.2 million), and Vietnam (-100,000, from 6.2 to 6.1 million).

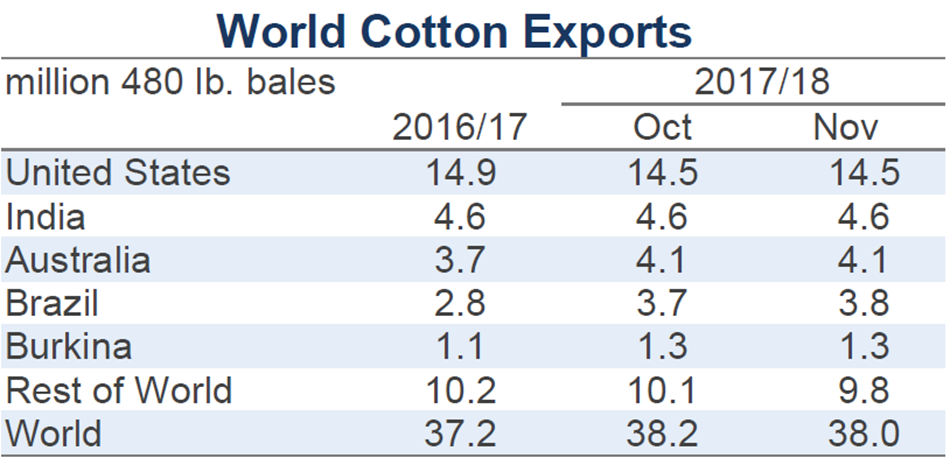

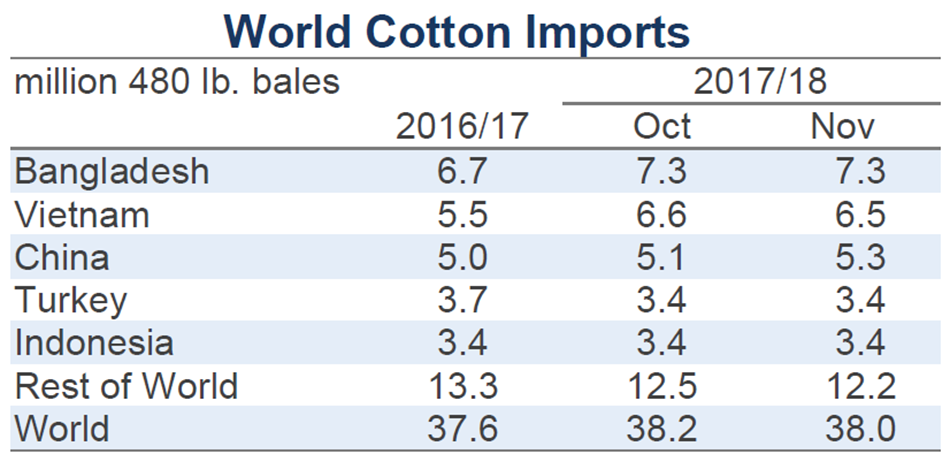

Global trade figures were mostly unchanged (-170,000 bales, from 38.2 to 38.0 million). The largest updates to country-level import figures were for China (+200,000 bales, from 5.1 to 5.3 million), Vietnam (-100,000, from 6.6 to 6.5 million), and Malaysia (-100,000 bales, from 600,000 to 500,000). The only notable changes to country-level export figures were for Uzbekistan (-400,000 bales, from 1.6 to 1.2 million) and Brazil (+100,000 bales, from 3.7 to 3.8 million).

Price outlook

The Chinese government indicated that no purchases from the Chinese crop would be made for the reserve system between now and the end of February. This deflates rumors that the government might buy some of the current crop to rotate new supply into reserve inventory. Chinese officials also indicated that the start date for the next round of auction sales would be March 12th. As has been the case in recent years, the scheduled end for the auction is the end of August. However, as has been the case in recent years, that deadline can be extended for another month if market demand is determined to be sufficient to warrant an extension.

In the last round of sales, the Chinese government moved 14.8 million bales from reserves (3.22 million tons). Most estimates put the current reserve volume at a level a little above five million tons (around 24 million bales). Questions regarding the quality of that cotton remain, but the Chinese government recently indicated that there was still a relatively high volume of cotton from Xinjiang province (Xinjiang cotton is considered higher quality and has been preferred over cotton grown in other growing areas at auction).

The USDA is predicting a decrease in Chinese ending stocks in 2017/18 (ending stocks include both cotton stored in reserves as well as private inventories held by mills and traders) of a similar magnitude as last crop year (-9.8 million bales year-over-year in 2016/17, -8.8 million bales forecast in 2017/18 to 39.7 million). If realized, Chinese stocks would be about 40% lower than they were at their peak in 2014/15 (66.9 million bales). However, the forecast for 2017/18 is still about twice the volumes that were common ahead of the 2010/11 price spike.

Nonetheless, another reduction in reserves of a similar magnitude as last year (-14.7 million bales) would leave only about two million tons in reserves (around ten million bales), implying that another decrease of a similar volume would not be possible in 2018/19. If China's production deficit is assumed stable, this suggests that China will have to look to new supplies to feed mills in 2018/19. Some of that cotton could come from a drawdown in private inventories, but some of it should be expected to come from imports.

By reaching a new record for stocks this crop year, the world outside of China is building a cushion against an eventual rise in Chinese imports. A key question for prices when Chinese imports increase is how rapidly it might happen. If China feathers increases over a period of several crop years, gradually lifting imports from the current level near five million bales to those near the current production deficit of 14 million bales, acreage outside of China will have time to respond to the increase in demand. A sudden shift from current levels of imports to those two to three times higher (from 5 to 14 million bales) could be expected to provoke a more dramatic reaction in prices.

A factor that should help counter the effects of rising Chinese import demand on prices are current record levels of global stocks for corn and soybeans. Since these crops can compete for cotton acreage, the low prices for these crops resulting from high stock levels make it easier for cotton to maintain or increase acreage, and therefore make it easier for cotton to maintain or increase production. This support for cotton production will help offset the effects of an eventual increase in Chinese import demand.