Monthly Cotton Economic Letter (2017.10)

Nov 23, 2017 | by Flora

Recent price movement

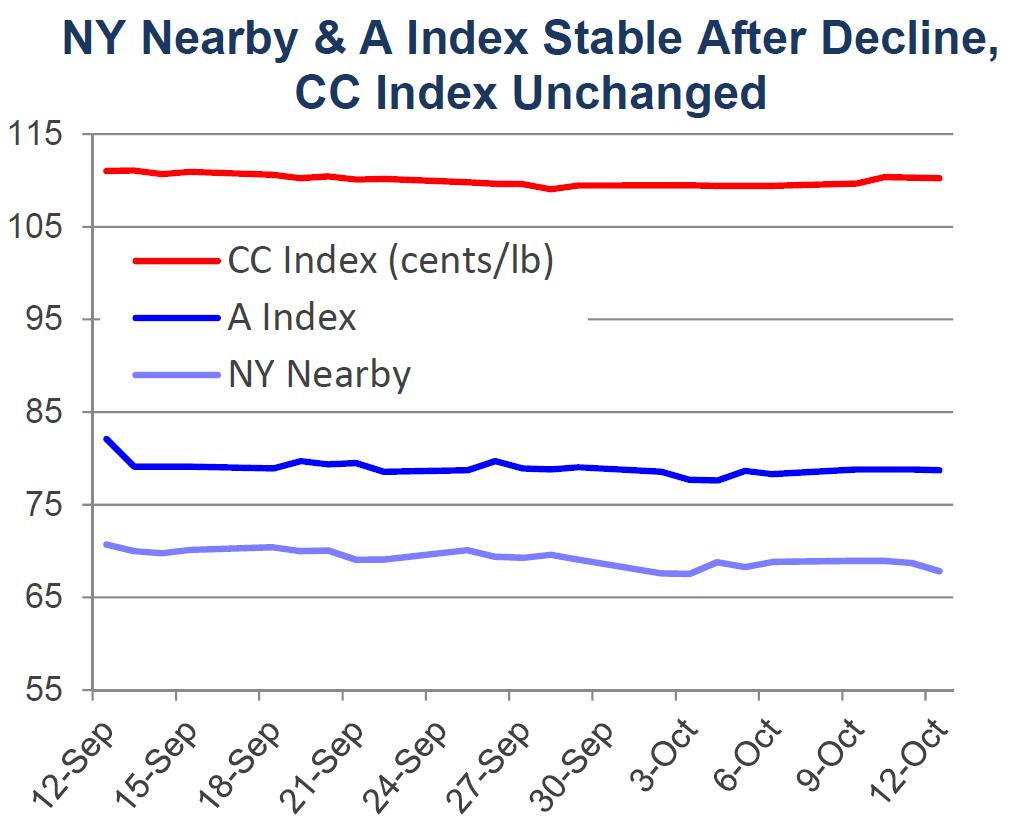

After falling in the days surrounding the release of last month’s USDA report, NY futures and the A Index were mostly stable through the second half of September and into early October. The CC Index and Pakistani prices were stable over the past month. Indian prices declined.

· Values for the NY December futures contract fell in the days surrounding the release of last month’s USDA report. This was likely a combined result of hurricane Irma (which made landfall shortly ahead of the report) being weaker than was feared and the USDA significantly increasing its U.S. production forecast last month. Prices dropped from levels near 75 cents/lb in early September to those near 69 cents/lb in the middle of the month. Since then, prices have been relatively stable near 69 cents/lb.

· The A Index followed the same general pattern as NY futures. Values for the A Index decreased from levels near 85 cents/lb in early September to those near 79 cents/lb in the second half of the month and were generally unchanged through the first half of October.

· The China Cotton (CC) Index was stable in international terms over the past month, with values holding to levels near 110 cents/lb. In domestic terms, the CC Index increased slightly, climbing from 15,900 to 16,000 RMB/ton.

· Cash prices for the Indian Shankar-6 variety decreased over the past month. In international terms, values fell from 85 cents/lb to 75 cents/lb. In domestic terms, values fell from 42,200 to 38,800 INR/candy.

· Pakistani prices have been mostly stable in both international and domestic terms since early September. In international terms, Pakistani spot rates held to values near 69 cents/lb. In domestic terms, prices hovered around 6,000 PKR/maund.

Supply, demand, & trade

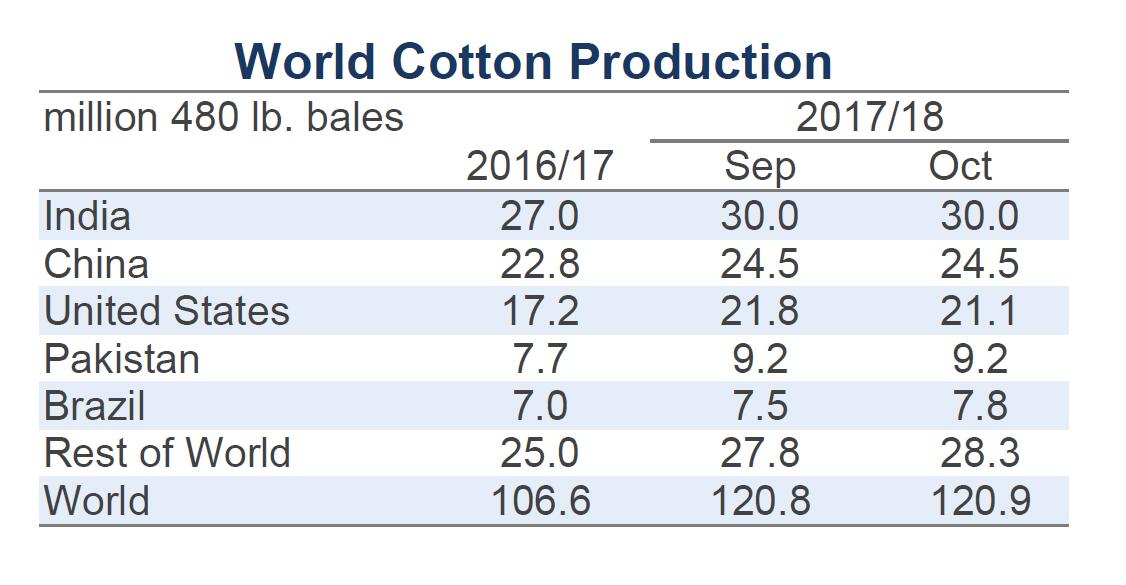

This month’s USDA report featured slight increases to global production and mill-use figures. The world harvest figure increased 112,000 bales, from 120.8 million 120.9 million bales. The world consumption forecast increased 262,000 bales, from 117.8 million to 118.0 million.

With world beginning stocks unchanged and the increase in mill-use greater than the increase in production, there was a marginal decrease in the forecast for global ending stocks (-156,000, from 92.5 to 92.4 million bales). Stocks outside of China are still expected to set a new record by relatively wide margin in 2017/18 (52.9 million), exceeding the previous record by 8.1 million bales or by nearly 20%. The stocks-to-use ratio for the world outside of China is also expected to set a record by a relatively wide margin (62.5% in 2017/18, previous record of 56.4% in 2008/09).

USDA reports for the past two months have been dominated by upward revisions to production figures for the U.S. Even though the magnitude of change this month (-643,000 bales, from 21.8 to 21.1 million) is smaller than the revisions in excess of one million bales made in each of the two previous months, this month’s change is nonetheless important for price direction because it addresses lingering questions related to hurricane damage. Last month’s report was issued in the immediate aftermath of both Harvey and Irma and there was limited ability to estimate storm damage. Over the past month, the USDA conducted field surveys in areas hit by the hurricanes and this month’s decrease to the U.S. production figure incorporates findings from that effort. Indications are that the storms caused damage in the form of yield loss (national yield lowered 3% from the record forecast in September) and a decrease in harvested acres (national harvested acres down 1% month-over-month, from 11.5 to 11.4 million).

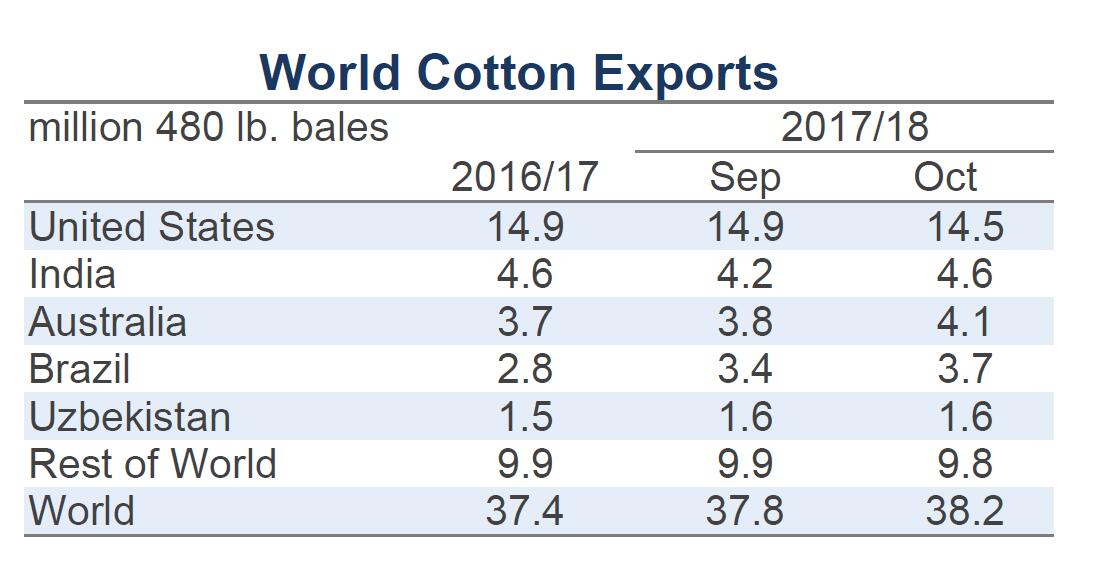

Relative to the effect on U.S. ending stocks, the decrease in production was partially offset by a reduction to the export forecast (-400,000 bales, from 14.9 to 14.5 million). U.S. stocks are still expected to increase significantly in 2017/18, with the forecast suggesting warehoused supplies will more than double year-over-year, rising from 2.8 million bales at the end of the 2016/17 to 5.8 million bales at the end of 2017/18.

Outside the U.S., the largest country-level changes to production forecasts included those for Argentina (+350,000, from 0.7 to 1.1 million), Brazil (+300,000, from 7.5 to 7.8 million), and Greece (+100,000, from 1.1 to 1.2 million). There was only one notable change to country-level consumption forecasts, and that was for Vietnam (+250,000, from 6.0 to 6.2 million).

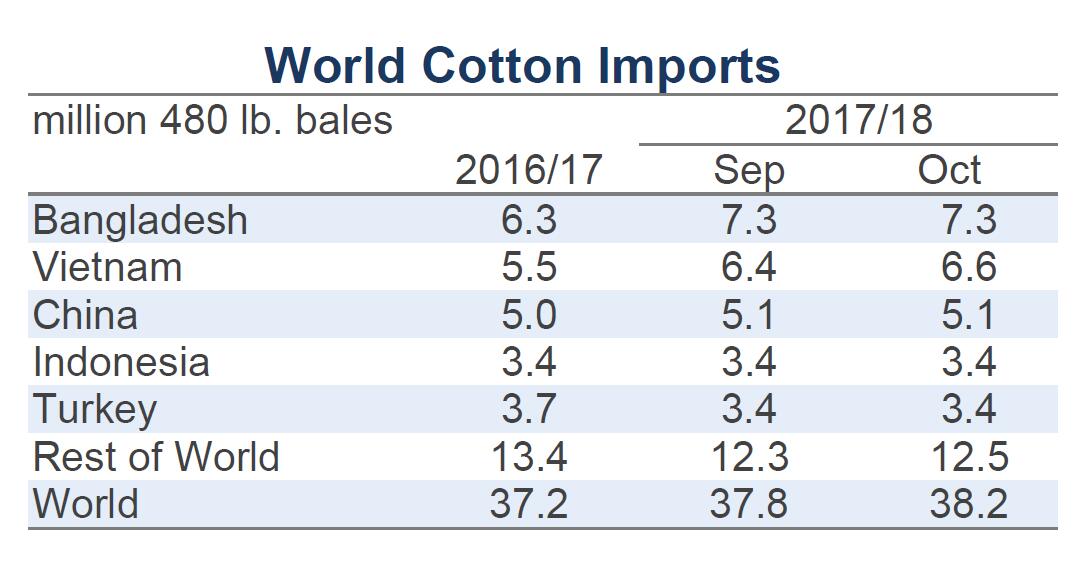

The global import forecast increased nearly 400,000 bales, from 37.8 to 38.2 million bales. This was a primarily result of upward revisions to India (+300,000, from 1.3 to 1.6 million) and Vietnam (+200,000, from 6.4 to 6.6 million) more than offsetting decreases for Mexico (-150,000, from 1.0 to 0.8 million). Beyond the U.S., the largest changes for exports included those for India (+400,000, from 4.2 to 4.6 million), Australia (+300,000, from 3.8 to 4.1 million), Brazil (+250,000, from 3.4 to 3.7 million), Argentina (+125,000, from 200,000 to 325,000), and Turkmenistan (-150,000, from 600,000 to 450,000).

Price outlook

For price direction, there has been a push-and-pull dynamic resulting from the U.S. production outlook. On one side has been fear related to storm damage and uncertainty involving cotton that has yet to be harvested. On the other side, there is this year’s 20% increase in planted acreage and generally good growing conditions outside areas impacted by hurricanes.

As more acres are harvested in the U.S. and in other exporting countries, it could be expected that the market’s attention may shift towards the large volume of cotton to be collected. Even though the production forecast was lowered in this month, this year’s U.S. harvest currently ranks as the fifth biggest of all-time. India is projected to collect its second largest harvest on record, and so is Australia. Every one of the world’s major cotton growing countries increased cotton acreage in 2017/18, and every one of the world’s major exporting countries are expected to have an increase in ending stocks this crop year.

Exporters will increasingly be looking to move supplies as harvests come in, and the corresponding competition for sales in import markets could be expected to weigh on prices. There is a possibility that China could absorb some of this additional supply by increasing imports. However, even after factoring in another round of auctions next spring/summer, the USDA still expects China to have enough stocks at the end of the 2017/18 to result in a stocks-to-use ratio over 100%. With so much supply at home, uncertainty surrounds the question whether China will increase imports.