Monthly Cotton Economic Letter (2015.11)

Dec 24, 2015 | by

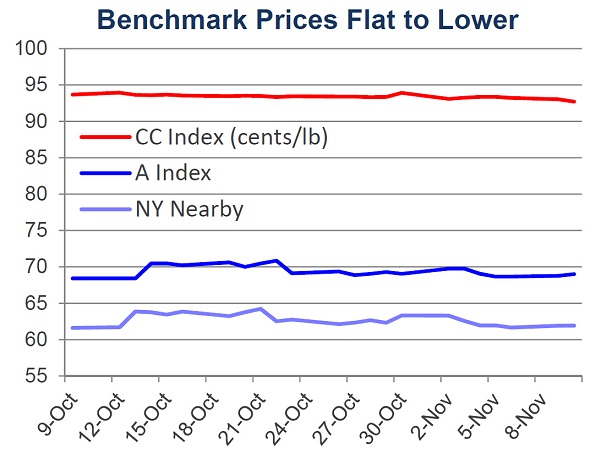

Recent price movement

Global cotton prices were flat or slightly lower over the past month.

l Prices for the December NY futures contract eased from levels near 64 cents/lb to those below 62 cents/lb.

l The A Index was essentially unchanged, and held consistently to values near 70 cents/lb since early October.

l The CC Index was stable in international terms (93 cents/lb) but slightly lower in domestic terms (from 13,100 to 13,000 RMB/ton).

l Indian prices decreased slightly. In international terms, values for the Shankar-6 variety fell from 64 cents/lb to 62 cents/lb. In domestic terms, values decreased from 32,800 to 32,100 INR/candy.

l Cotton prices in Pakistan were flat, with prices holding near 62 cents/lb or 5,300 PKR/maund.

Supply, demand, & trade

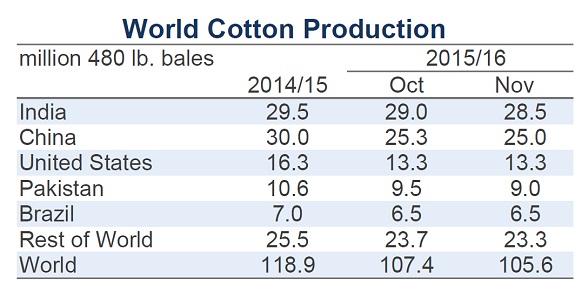

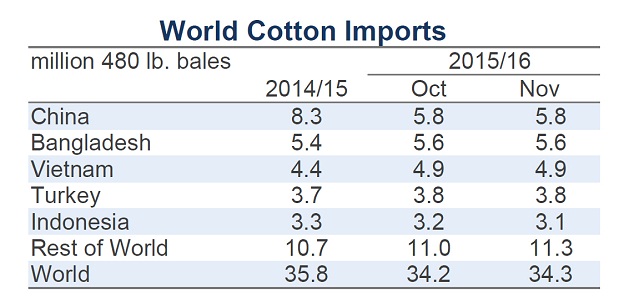

This month’s USDA report featured decreases to forecasts for 2015/16 world cotton production and consumption. The global production figure was lowered by more than one million bales for the second consecutive month. With this month’s decrease of 1.8 million bales, the projection fell from 107.4 to 105.6 million bales. If realized, this would be the second smallest crop in recent history, only slightly above the 103.4 million bales harvested in 2009/10. The world mill-use figure was lowered 680,000 bales, from 112.3 to 111.6 million.

At the country-level, changes to production forecasts were widespread. The largest decreases were for India (-500,000 bales, to 28.5 million) and Pakistan (-500,000 bales to 9.0 million), where infestations of whitefly have been reported. Other significant reductions to harvest estimates were made for China (-300,000 bales, to 25.0 million), Greece (-150,000 to 1.1 million), Mali (-100,000, to 1.1 million), and Mexico (-100,000, to 1.0 million). Country-level changes to mill-use figures were centered on China (-500,000 bales, to 33.0 million) and Pakistan (-150,000, to 10.3 million).

In combination, the decreases in production and consumption resulted in an 880,000 bale decrease in the projection for world ending stocks. The current estimate of 106.1 million bales indicates that the volume of cotton in storage at the conclusion of the 2015/16 crop year will be larger than the 2015/16 harvest and highlights how much cotton supply exists at the world-level, even if the crop is smaller than previously estimated.

Price outlook

After several years of delays, the Intercontinental Exchange’s (ICE) world cotton futures contract began trading on November 2nd. The specifics involved in the new world cotton contract (trading symbol WCT) can be seen as a blend of details related to NY futures and the A Index. Although the only WCT contract month currently being traded on the new exchange is May 2016, WCT contract months will eventually be the same as those for NY futures (March, May, July, October, and December).

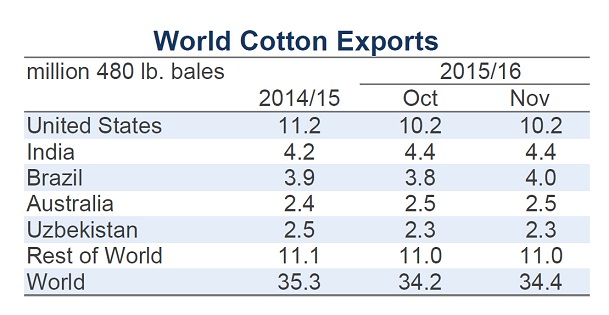

Details associated with the cotton eligible for delivery against positions on the new exchange approximate those associated with the derivation of the A Index. The A Index is based on export offers from many of the world’s largest shipping countries. Similarly, the countries of origin permitted for delivery against WCT futures include many of the world’s largest cotton exporters. Specifically, cotton grown in the U.S., Australia, Brazil, India, and several West African countries are eligible for delivery against WCT contracts.

The quality requirements for the cotton qualified for delivery are also similar to those of the export offers used to derive the A Index. The base grade for WCT futures is Middling 1-1/8”, which is the same as the “medium” quality specification Cotlook requires for the quotes considered for inclusion in the A Index (for NY futures, the quality is Strict Low Middling 1-1/16”). Another similarity between WCT contracts and the A Index relates to delivery locations. Base delivery points for WCT contracts are in Malaysia and Taiwan, while all of the export offers eligible for consideration in the A Index are in Asian ports. These similarities in quality and delivery location suggest that the values for WCT contact could be expected to be close to those for the A Index. In the first week of trading, both WCT prices and the A Index were near 70 cents/lb.

A founding motivation for the establishment of the new exchange was that it would allow merchants and mills to hedge on a platform based on global supply and demand. Although merchants have longed used NY futures to hedge physical positions held in cotton grown in numerous countries around the world, only U.S. cotton is eligible for delivery against NY futures and this suggests that the U.S. supply and demand situation might have an outsized influence on NY prices. Another benefit of the WCT contract is that delivery points are in Asia, where the majority of the world’s spinning occurs. Delivery points for NY futures are all in the U.S. This geographic shift may make WCT contracts more useful to the world’s mills than NY futures have been.

However, for the WCT exchange to become an effective tool for hedging, it will need widespread participation. The more merchants and mills that use it, the more it will be trusted. In turn, this could lead even greater levels of trust and usage. A challenge for the new exchange will be in starting this positive feedback cycle. Total trading volume on the WCT exchange in the first full week of operation was only 345 contracts. For perspective, daily trading volume in NY futures was between 25,000 and 50,000 contracts that same week. The lack of initial trading activity on the WCT exchange suggests it is not very liquid and that it could be a risky market to enter.

Regardless, the direction of WCT prices can be expected to be dominated by the same set of factors driving movement in cotton prices around the world. Those factors include a high level of global supply, tightness in stocks in certain key countries, like the U.S., as well as sluggish global demand. In combination, these factors suggest continued range-bound movement for all prices.