China-US trade and cotton textile market week dynamics (3.6 - 3.12)

Mar 24, 2020 | by

On March 7, the General Administration of Customs, P.R. China announced the trade data for January - February 2020. Due to the impact of the Spring Festival holiday extension and the COVID-19 epidemic, the foreign trade in the first two months had a significant decline. In terms of Renminbi, the country’s total foreign trade imports and exports fell by 9.6%, of which exports fell by 15.9% and imports fell by 2.4%. From the data point of view, the impact of textile and clothing exports is greater than the overall trade in goods. In addition, the total value of Sino-US trade dropped by 19.6%.

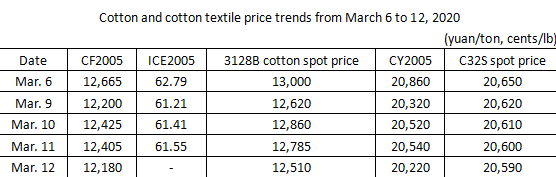

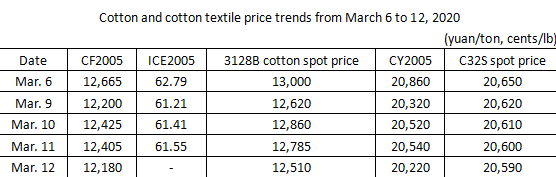

Judging from the spot prices of cotton textile-related products at home and abroad this week, the overall price has weakened and the decline has accelerated. On March 12, the settlement price of the main cotton contract was 12,180 yuan/ton, which was more than 200 yuan/ton lower than the settlement price of the previous day, and 500 yuan/ton lower than the same period last week. The settlement price of the main contract for cotton yarn on the same day was 20,220 yuan/ton, a decrease of more than 700 yuan/ton from last week. The spot market is also not optimistic. On March 12, the price index of 3128B cotton was 12,510 yuan/ton, a decrease of more than 500 yuan/ton from the same period last week. The yarn price index of the same day was 20,590 yuan/ton, a slight decrease from the same period last week. U.S. cotton futures also performed weakly, with a settlement price of 61.55 cents/lb on March 11, a decrease of nearly 2 cents/lb from the same period last week.