U.S. manufacturing faces USD 400 billion COVID-19 impact

Dec 02, 2020 | by Zhao xh

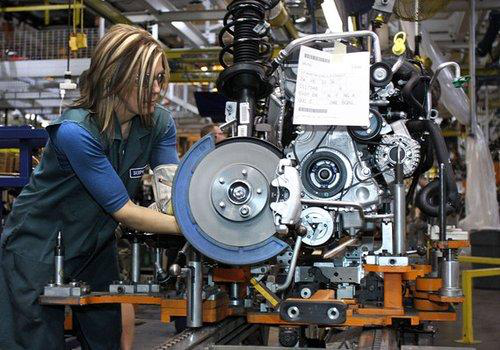

The U.S. manufacturing industry, including the apparel and textile sector, is on the verge of severe negative impacts due to COVID-19, according to a new report from global business intelligence firm Creditsafe.

The report said many manufacturers, also including industrial machinery equipment, printing and publishing, and fabricated metal products, could see a significant decrease in their revenue and face difficult decisions on how best to navigate these difficult times.

Taken together, the industries represent over half a million businesses across the country, with more than 17 percent of them expected to experience a severe downturn and financial crisis from the economic impact of the coronavirus.

“Manufacturing represents a significant amount of revenue, jobs and businesses within the U.S.,” said Matthew Debbage, Americas and Asia CEO for Creditsafe, a global supplier of company credit reports. “Our research and analysis shows that the 10 most affected states could see a decrease of USD 400 billion from the manufacturing industry alone. This type of impact will have long term effects for the entire country.”

According to the National Council of Textile Organizations, the U.S. textile industry supply chain, from textile fibers to apparel and other sewn products, employed 585,240 workers last year. U.S. textile and apparel shipments totaled USD 75.8 billion in 2019.

The report said 31,735 manufacturers that produce clothing and other textile products including yarns, fabrics and home furnishings that were reviewed for the report, and 5.8 percent of them are likely to face severe risk.

Factors such as mandatory closures, changes in buyer behavior and disruptions to the supply chain are all contributing to the overall risk that the manufacturing industry is facing. These could then cause ripples through a loss of employment, decreases in revenue and delays in production, Creditsafe noted.

The pandemic has caused the U.S., and specifically manufacturers, to look to a more localized supply chain and bring several types of critical manufacturing sectors back on shore.

“The pandemic has made it clear that overextended and risky supply chains can no longer be tolerated,” John Boyd, president of Boyd Co., a corporate relocation consulting firm, said.

President-elect Joe Biden’s economic plan encourages reshoring through tax breaks and other incentives. Creditsafe cited the April Thomas Industrial Survey showing that 64 percent of manufacturers surveyed planned to bring production and sourcing back to North America, with 25 percent increasing their use of automation.

The pandemic may impact USD 400 billion in revenue in 2020, according to the report, which cites states such as Nevada and California as the top two most affected regarding manufacturing.

“Ultimately, manufacturers that are able to build agility into their business models will be able to come through the crisis with better protection for the next one, and states that are able to develop tax incentives to attract manufacturers will benefit, despite the current loss of revenue,” the report said.

Source: sourcingjournal.com