Q1 net profit surged by 258%,revealing where the strength comes from in the financial report

Aug 07, 2025 | by Qiu Shuchen

Lianfa Textile (002394) was founded in 1955. After decades of hard work, it has gradually grown into a large-scale textile enterprise with operations ranging from cotton processing to garment production. Its business covers cotton spinning, yarn-dyed weaving, printing and dyeing, home textiles, knitting, clothing, brands, trade, logistics and new energy, among others. The company's main products include six series: yarn, yarn-dyed fabrics, printed and dyed fabrics, home textile fabrics and clothing. It is characterized by good quality, high technical content, and eco-friendly features. Its products are exported to dozens of countries and regions such as Japan, the United States, the United Kingdom, and Italy. It is not only one of the world's high-end yarn-dyed fabrics and high-end brand shirt manufacturers, but also a unique textile ecosystem with a full industrial chain.

Declining revenue, strong earnings

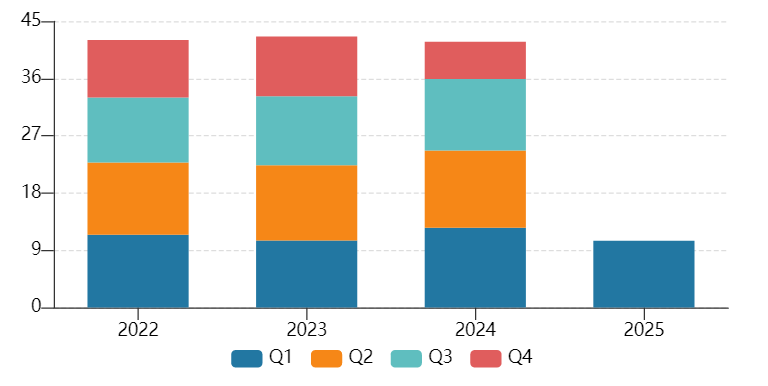

In the first quarter of 2025, Lianfa Textile released its quarterly financial report. The company's operating income in 2025Q1 was 1.05 billion yuan, a year-on-year decrease of 16.11% from the operating income of 1.252 billion yuan in the same period last year. Although the operating income decreased, the net profit attributable to shareholders of the listed company was 72.8982 million yuan, an increase of 258.32% over the same period; the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses was 59.2745 million yuan, a year-on-year increase of 7.29%.

Figure 1: Quarterly Trends in Operating Income (unit: 100 million yuan)

Since nearly half of Lianfa Textile's business market is in more than 30 countries and regions such as Europe, Japan and Southeast Asia (the company's overseas market total operating income accounted for 42.10% in 2024), it is significantly affected by the uncertainty of the international market. The slowdown in the growth rate of the core business textile and clothing sector is the main reason for the decline in revenue. From a macro perspective, it is mainly due to the weak demand in the global textile industry, the reduction in orders, and the periodic pressure on industry demand.

Despite this, as a leading company in the domestic textile industry, Lianfa Textile's operating income in 2024 still exceeded 70.64% of listed companies. Among them, the fabric business, Lianfa's pillar industry, contributed 58.95% of the operating income, amounting to 2.463 billion yuan; the proportion of operating income generated by electricity, steam, sewage treatment, and compressed air has increased year by year, with a year-on-year increase of 8.16% in 2024. This is closely related to the company's strategy of attaching importance to the cluster of the entire industrial chain. As the scale of this supporting service grows, the internal synergy effect will further enhance the development of the company.

Although the operating income declined slightly, the net profit increased by 258.32% during the same period and the overall gross profit margin increased to 18%. This is a very good result, reflecting the effective internal cost control of the enterprise. In the first quarter of 2025, the total operating cost of Lianfa Textile decreased by 17.80% year-on-year. The total of sales expenses, administrative expenses and financial expenses was about 89 million yuan, and the expense rate was 8.48%. Among them, the financial expenses decreased significantly, down 33.33% year-on-year, which reduced the burden on the enterprise to a certain extent. At the same time, combined with the changes in the proportion of revenue of each product line in 2024, the company is also vigorously promoting high-value-added and high-return product lines. The product lines with low added value that drag down the overall profitability are gradually weakening. A series of measures have successfully promoted the sharp increase in net profit. The sharp increase in net profit is also accompanied by high-quality cash flow. In the first quarter of 2025, the net cash flow generated by Lianfa Textile's operating activities was 122 million yuan, covering 165% of the net profit (74 million yuan), which provided cash support for the company's daily operations to a certain extent, reflecting the steady and orderly operation of the company.

Industrial linkage and collaborative efforts

With the passage of time and the pioneering work of several generations of textile workers, Lianfa Textile has a strong and complete industrial chain. From the initial cotton processing to the consumer terminal, the extension of vertical integration enables the company to have extremely strong synergy effects. At present, the company has cotton ginning, spinning, yarn dyeing, weaving, yarn-dyed fabric finishing, knitting dyeing, home textile fabrics, clothing fabric printing and dyeing, clothing industry chain, thermal power, sewage treatment supporting industry chain, etc. Each chain is coordinated and complementary, and can be flexible and quick in resource allocation, cost control and responding to market reactions. This is also an important reason why Lianfa can achieve a sharp increase in net profit in the first quarter of 2025.

Table 1 Lianfa’s industry chain links

|

Industry chain links |

Main content |

|

Upstream raw materials |

Includes cotton procurement and processing, providing basic raw materials for subsequent textile production; |

|

Midstream Manufacturing |

Complete textile manufacturing chain, including: cotton spinning, yarn-dyed weaving, printing and dyeing, fabric finishing, and garment making; |

|

Downstream sales |

Domestic market: sold in over 20 provinces and cities nationwide

International market: exported to 30 countries and regions including Europe, Japan, and Southeast Asia;

Independent spot fabric men's clothing brand: James Fabric; women's clothing brand: INITS; mass-market brand: Yizhiyuan

Own clothing brand: James Kingdom high-end shirts; |

|

Supporting Services |

Including logistics, trade, property management, sewage treatment, energy supply (electricity, steam, compressed air), etc., to form internal synergy effects. |

In addition, Lianfa Textile also has strong industrial technology, with a national enterprise technology center, Jiangsu Provincial Key Laboratory of Ecological Dyeing and Finishing Technology and Jiangsu Lianfa High-end Textile Technology Research Institute, focusing on the research and development of high-end textiles and the exploration of ecological textile technology. At the same time, the manufacturing plant implements GB, Japan JIS, UK M&S, and US AATCC standards, which are the highest quality standards for international textile products, to ensure that the rate of superior products remains above 99%, and that the products are high-quality as soon as they leave the factory, ensuring the company's good reputation in the industry. The excellent technology and the company's own upstream and downstream industrial chains go hand in hand, going against the turbulent trend.

Based in China, expanding overseas

Lianfa Textile has established a well-developed overseas market system. Among them, the European and American markets are the main trading bases, and the products cover fabrics, cotton yarn, etc. The products all meet the local market standards in Europe and the United States. Through domestic foreign trade companies to receive orders, set up overseas subsidiaries or offices, strengthen the connection with the international market, and finally cooperate directly with international first-line brands to improve the response efficiency of market services and the satisfaction of overseas customers.

Secondly, Lianfa Textile takes Southeast Asia as the main manufacturing base, relying on the two advantages of local low-cost manufacturing and proximity to the consumer market to disperse domestic competitiveness. At present, 50% of Lianfa Textile's clothing production capacity is distributed in Cambodia, with a capacity utilization rate is as high as 87.66%. In addition, the company also plans to build high-end clothing fabric projects in Southeast Asia, which will further improve Lianfa Textile's production capacity. Through the two major overseas trade and manufacturing industry centers, Lianfa Textile has successfully dispersed some of the domestic competitive pressure and further enhanced its own strength.

Embrace risks and challenges

As a large leading textile enterprise, Lianfa Textile attracts a steady stream of imitators and competitors. In 2025, the decline in revenue and the intensification of competition all show the structural challenges from the market. At present, the risks of enterprises are mainly in the following aspects:

1. The impact of the macro environment. It mainly comes from factors such as the differentiation of global monetary policies, the tightening of geopolitical environment and the rise of trade protectionism. Since the company's export business accounts for a large proportion, it is more susceptible to the impact of international market demand; and the business activities are settled in foreign currencies, and exchange rate fluctuations are also likely to have a certain impact on the company's operations.

2. Changes in raw material prices. Fabrics and clothing are the core pillar industries in the company's industrial chain. Its main raw materials are cotton and thermal coal. The prices of the two are affected by many factors. Financial instruments are used to hedge against the risks arising from raw material price fluctuations.

3. Market and industry competition risks. The textile industry is a traditional industry in China. After several years of development, it has become highly homogeneous. How to stand out from many companies and maintain a stable leading position requires combining its own strengths.

In the face of risks, Lianfa Textile has fully demonstrated the advantages of a complete textile industry ecosystem built over many years of hard work. By deepening and extending the entire industrial chain, it has improved the overall operational efficiency of its business and enhanced its market competitiveness. In the future, Lianfa will continue to forge ahead and is worth looking forward to in the uncertain international market.

(Data source: Wind/Lianfa Textile 2024 Annual Report/Lianfa Textile 2025 First Quarter Report)