Revenue increased by 370%, new channels for new domestic products: Taihu Snow

Aug 07, 2025 | by Qiu Shuchen

Taihu Snow (838262) is a home textile manufacturing company listed on the Beijing Stock Exchange in 2022. It is a bedding manufacturer focusing on silk products. The company was established on May 18, 2006. Centered around the "Taihu Snow" brand, its products cover suite products (such as pillowcases, quilt covers, sheets), quilt cores, silk scarves and other emerging retail products. It is positioned in the mid-to-high-end market in large and medium-sized cities, mainly targeting young consumer groups. In recent years, Taihu Snow has been committed to inheriting and promoting Chinese silk culture, especially on the basis of Suzhou silk culture, to create a new national trend brand with international influence. Through the innovative model of "Silk +", the company has launched a product matrix covering multiple scenarios such as home, office, car, and travel, and actively expanded a three-dimensional sales model combining online and offline, domestic and overseas.

Channels: Online and offline dual growth

Although the market of Taihu Snow was under certain pressure in 2024, in the first quarter of 2025, with the support of the national policy of "trade-in old for new", Taihu Snow achieved operating income of 116 million yuan, a year-on-year increase of 6.92%, showing a steady growth trend overall, and net profit increased by 9.41% year-on-year to about 8.08 million yuan; net profit after deducting non-recurring gains and losses was about 7.9 million yuan, a year-on-year increase of 47.45%. The company has achieved an improvement in profitability through product structure optimization against the background of a slight increase in revenue scale. This financial performance of "small quantity and large quality increase" is consistent with the overall trend of the home textile industry's transformation to high added value.

The increase in revenue is due to the simultaneous efforts of its online and offline channels. Among them, the online channel revenue was 53 million yuan (46.31%), a year-on-year increase of 7.54%, while the offline channel revenue was 62 million yuan (53.69%), a year-on-year increase of 5.67%. Although offline channels still account for a large share, the growth rate of online channels is faster, and they perform well in some sub-channels, as follows:

1. WeChat store channel (revenue accounted for 9.05%), a year-on-year increase of 370.76%, which was the channel with the largest increase in the first quarter of 2025 and the whole year of 2024. In 2024, the revenue of this channel increased by 387.64% year-on-year. Although the revenue share of Taobao, Jingdong and other large platforms is still large, facing the current situation that the traffic dividends of these traditional e-commerce platforms are gradually disappearing, Taihu Snow quickly cut into the blank channel, linked with influencers through WeChat video accounts to build a "grass-conversion" closed loop, actively expanded WeChat stores (mini programs, public accounts, video accounts, etc.), which still have great room for development, and built an ecological cycle of "social + content + e-commerce". The "Send gifts to good friends" function was launched, and through the attributes of social e-commerce, user fission and dissemination were promoted, showing a strong revenue growth potential, and also directly reflecting Taihu Snow's rapid expansion capabilities in emerging channels.

2. For channels with a large proportion, such as Taobao,Jingdong and Tiktok, Taihu Snow uses the "self-broadcast + expert broadcast" dual-wheel synergy strategy to use brand self-broadcasting to build a private domain traffic pool and expand public domain traffic exposure with the help of expert live broadcasts. Short videos and live broadcasts have attracted users' interest and improved customer stickiness and conversion rates. According to the investor Q&A released by Taihu Snow, the Tiktok has set a target of 4.2 trillion yuan in gross merchandise volume (GMV) in 2025, and plans to increase subsidies for shelf e-commerce. With a series of layouts, it can be foreseen that the Tiktok channel will further improve its sustainable profitability while maintaining steady growth, and gradually become one of the pillars of the online channel.

3. Refined operation of cross-border e-commerce in overseas channels. According to Sina Finance, Taihu Snow officially entered the Amazon platform in 2015, established an overseas official website in 2018, and introduced the company's brand "THXSILK" into the overseas market through the marketing strategy of "Made in China + Brand Going Overseas". Since the overseas market has a higher premium acceptance of traditional Chinese culture, the product has a higher gross profit margin. Through cultural empowerment, it abandons the simple pursuit of GMV maximization and focuses on unit product profit margins. Through overseas trade platforms and mainstream social media platforms (Facebook, Instagram, etc.), Taihu Snow gradually penetrates into the consumer market of middle-class families in Europe and the United States, filling the gap in the domestic market.

Table 1: Revenue growth of online channels

|

Platform |

Revenue in Q1 2025 (10,000 yuan) |

Proportion |

Year-on-year growth rate |

|

Taobao |

1438.12 |

28.11% |

-20.24% |

|

Jingdong |

804.83 |

15.73% |

+70.57% |

|

Tik Tok |

1102.14 |

21.54% |

+18.78% |

|

Wechat |

463.19 |

9.05% |

+370.76% |

|

Amazon |

996.92 |

19.49% |

+2.43% |

|

Overseas official website |

310.52 |

6.07% |

-27.46% |

|

Total |

5115.72 |

100.00% |

+8.79% |

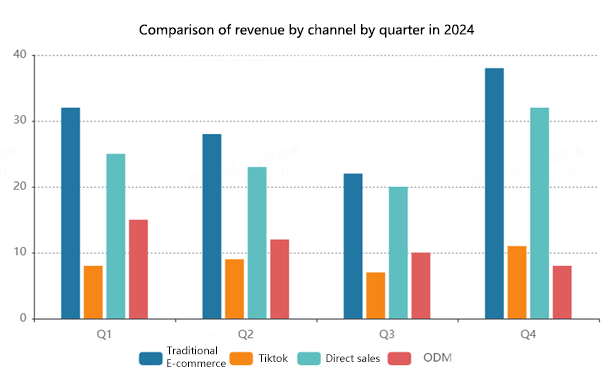

Figure 1: Comparison of revenue by channel by quarter in 2024

(Data source: Wind; Unit: 100 million yuan)

Products: Core Prominence and Diversified Synergy

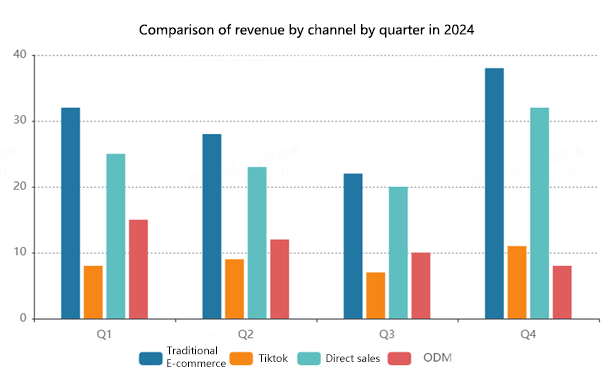

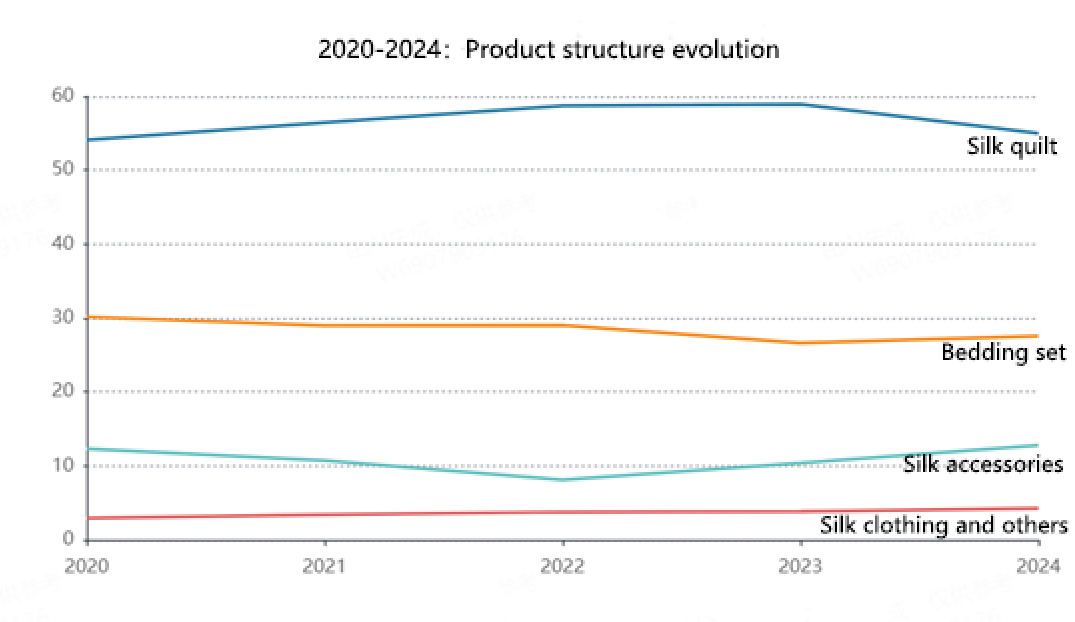

Looking at its product revenue structure, it is clearly dominated by core products.

Figure 2: Product revenue structure

Core categories: Silk quilt + bedding set

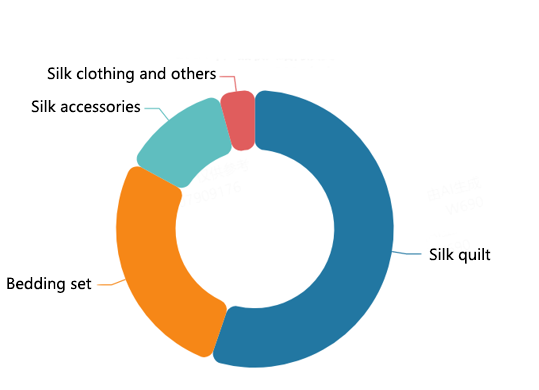

"For silk quilts, choose Taihu Snow". Silk quilts are the company's main category for entering the mid-to-high-end market and are Taihu Snow's absolute core product. In 2024, Taihu Snow's silk quilt revenue reached 283 million yuan. Although it has decreased year-on-year, it still accounts for 54.97%, and its income dependence is relatively high. As the pillar business of Taihu Snow, silk quilts embody the company's innovative technology. They use high-quality mulberry silk through intangible cultural heritage silk drawing techniques to solve the problem that traditional silk quilts are difficult to clean, easy to compact, and need to be frequently turned over and disassembled, making them unique in the market. According to the "China Silk Quilt Industry Market Position Statement" issued by Frost & Sullivan (Beijing) Consulting Co., Ltd. in 2024, from 2019 to 2023, Taihu Snow has been the national silk quilt franchise brand online channel sales champion for five consecutive years. At the same time, in terms of pricing, silk quilts in the main price range performed well in the Taobao Double Eleven promotion in 2024, with products in the 1,000-1,500 yuan price range topping the best-selling list, showing consumers' high recognition and pursuit of brand value. However, it cannot be ignored that the silk quilt business has a certain degree of instability. In 2024, the proportion of silk quilt revenue decreased by 9.46 percentage points, and the actual revenue decreased by about 30 million yuan compared with 2023, due to a decrease of 25.12 million yuan in ODM customer orders. The instability of corporate customer centralized procurement business constitutes the main impact on revenue, and also exposes the risk of over-reliance on large customers.

As the second largest source of income for Taihu Snow, bedding set has performed very stably. In 2024, with a record high of 142 million yuan in operating income, it contributed 27.56% of the market share, showing a certain anti-cyclical characteristic against the background of insufficient consumer power. In terms of design, the bedding set is based on the local cultural elements of Suzhou, and cleverly integrates the traditional craft of Suzhou embroidery into bedding. The cultural IP jointly launched with Suzhou Museum, Grand Canal Museum, etc. has greatly boosted the premium ability and increased the gross profit margin of the product. It has also obtained multiple certifications such as "China Green Product" and "Jiangsu Boutique". In terms of technology, Taihu Snow innovatively combines with small machine embroidery technology to achieve three-dimensional embroidery on silk, interweaving classics with modernity to create a unique and durable product series. In terms of function, Taihu Snow focuses on the development of environmentally friendly functional silk products, such as temperature control and antibacterial, skin beauty and comfort, corresponding to the new trend of healthy sleep.

Figure 3: Comparison of silk quilt and bedding set revenue

(Data source: Wind)

Growth categories: silk accessories + silk clothing and others

Silk accessories mainly focus on light luxury accessories and small consumption. The revenue in 2024 is 66 million yuan, with a revenue share of 12.76% and a year-on-year increase of 19.09%, which verifies the effectiveness of the cultural empowerment strategy. By cooperating with the Suzhou Museum on the "Intangible Cultural Heritage" series of products and creating cultural IP joint content, it not only obtained the certification of the "National Cultural Industry Demonstration Base", but also effectively stimulated the premium space. In addition, Taihu Snow's silk accessories are also involved in daily necessities, such as silk eye masks, hair bands and scarves. These transactions are characterized by high frequency and low decision-making threshold consumption, which drives the increase in the quantity of product lines. Through the mutual complementation and synergy of "cultural and creative products + daily accessories", the gross profit margin of the entire business line of silk accessories is as high as 62%.

Secondly, although silk apparel and other products are relatively small in scale, their growth trend is the most stable. The gross profit margin of 53% in 2024 is much higher than that of traditional home textile products. If this differentiated competition strategy can continue to deepen, Taihu Snow will be expected to cultivate new growth points.

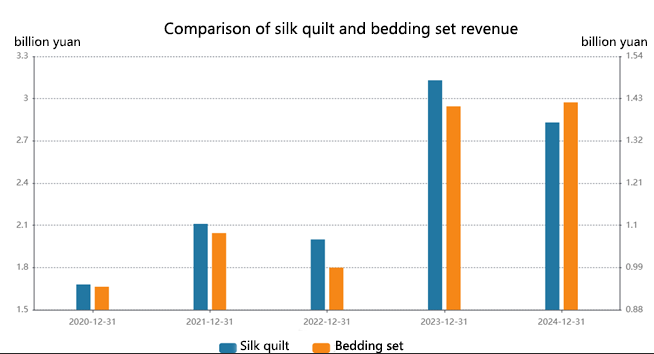

Figure 4: 2020-2024 Product structure evolution

(Data source: Wind)

Conclusion

Perhaps, the decline in Taihu Snow revenue in 2024 is not accidental, but the dual result of changes in the consumer environment and the company's active strategic adjustment. Analysis of China's silk quilt consumer market shows that the market size will reach about 26 billion yuan in 2024, a year-on-year increase of 10%. Taihu Snow's market share of about 1% seems slightly small in the entire market, but this smallness just shows that the simple pursuit of scale expansion may not be the best path. Taihu Snow is supported by the "unstable" silk quilt and the "anti-cyclical" bedding set. It establishes differentiated barriers through channel innovation and cultural empowerment. Although it may sacrifice some market share in the short term, the 62% gross profit margin in the subdivided field and the 47.45% non-net profit growth rate verify the feasibility of the "boutique strategy". At the same time, the characteristics of "traditional channels stabilizing + emerging channels rising", accompanied by the surge and conversion of private domain traffic, although it has caused certain fluctuations in revenue in the short term, it has helped companies reduce their dependence on third-party platforms and added significant flexibility and a virtuous cycle to the company's future revenue.