China’s children’s wear market in H1 of 2021

Aug 31, 2021 | by Zhao Xinhua

According to relevant data analysis, in the first half of 2021, the online sales of maternal and child-related categories reached 95.95 billion yuan, increasing by 4.0 percent compared with the same period last year, based on large e-commerce platforms such as Tmall and JD.com. Among them, Tmall is still the main sales platform for children’s clothes and shoes, accounting for 94.7 percent and 91.7 percent respectively.

Significant growth in sub-categories, large market for big kids

From the perspective of the entire life cycle of the fashion clothing industry, the children’s clothing industry is still in a stage of rapid growth compared to adult clothing industries such as men’s wear, women’s wear and sportswear, with obvious development characteristics of rapid market demand growth and large growth space.

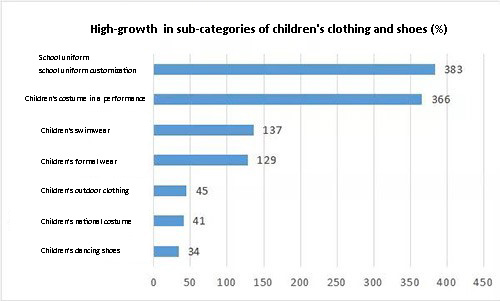

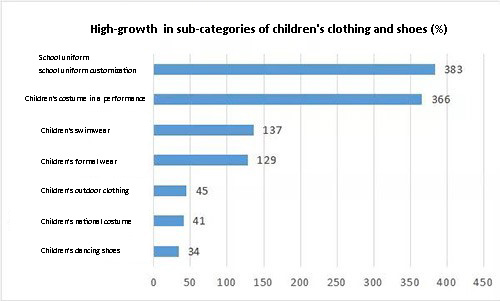

According to the relevant data analysis, from January to June 2021, in all the sub-categories of children’s wear, school uniform/school uniform customization, children’s costume in a performance and children’s swimwear occupy the top three growth rates, with the growth rate reaching 383.2 percent, 366.1 percent and 136.7 percent. Compared with jump suits and other categories, the rapid growth rate reflects the broad development space of the middle and large children market in China. Meanwhile, there are increasing demands for refined market around different dressing scenes and different age groups of children.

Industry resources are accelerating to gather to leading enterprises, more test for the comprehensive strength of brand, channel, marketing, etc.

Throughout the entire shoe and apparel industry, whether it is upstream brands or downstream channels, industry resources are accelerating to gather to the leading enterprises in the past two years. For the children’s wear industry, there is indeed a long way to go compared with categories with a high degree of brand concentration such as milk powder and diapers. However, since the outbreak of the pandemic in 2020, the survival of the fittest has accelerated in the children’s wear industry.

Data shows that brands such as Balabala, Dave&Bella, and Anta are still performing strong, while many brands have grown at a considerable rate, such as Peacebird’s children’s clothing brand Mini Peace, which grew by more than 20 percent in the first half of the year.

For example, in the past two years, the top brand of children’s clothing, Balabala, has made efforts to make the brand fashionable, upgrade the external brand image, and innovate the internal design of the store. It successively launched Disney series, Guochao series, Catimini, Dunhuang Museum crossover products and other cooperation series, as well as the renewal of the brand logo, etc.

Annil, another big brand of children’s wear, has been rejuvenated in recent years, and has integrated this into product innovation, brand marketing and other aspects. On the other hand, Annil continues to strengthen its direct marketing channel advantages, online and offline sales together, to create a diversified and convenient shopping experience for customers.

In general, with the industry competition intensifies, children’s clothing enterprises usher in a new stage of comprehensive strength PK. The online performance of each brand also represents a microcosm of the development of the industry, and the future of children’s wear industry is bound to be more brand-oriented, centralized direction.