Prosperity index of the national textile and apparel specialized market declined overall in May

Jun 25, 2021 | by Zhao Xinhua

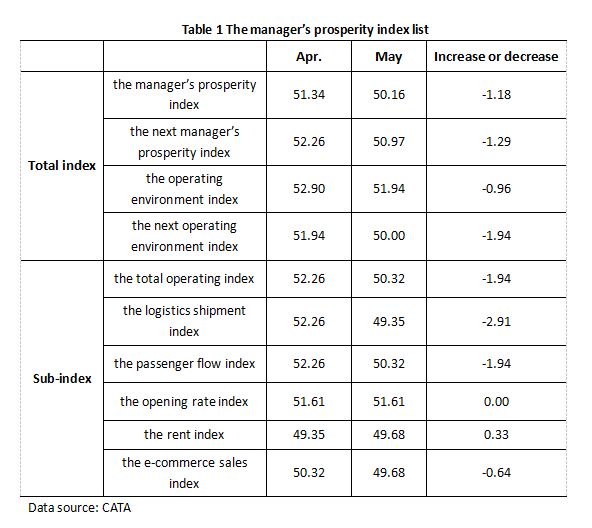

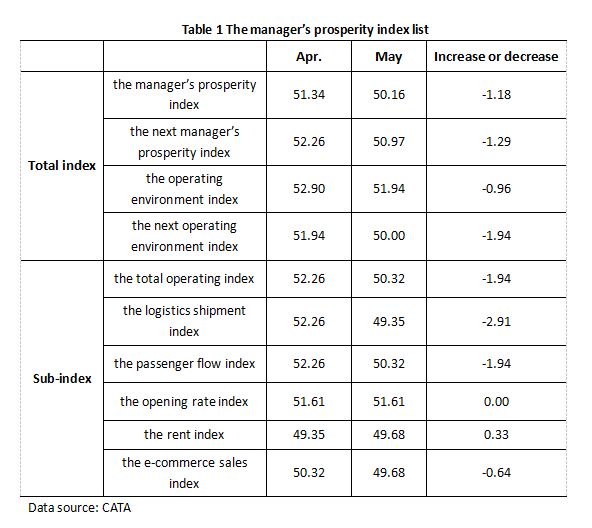

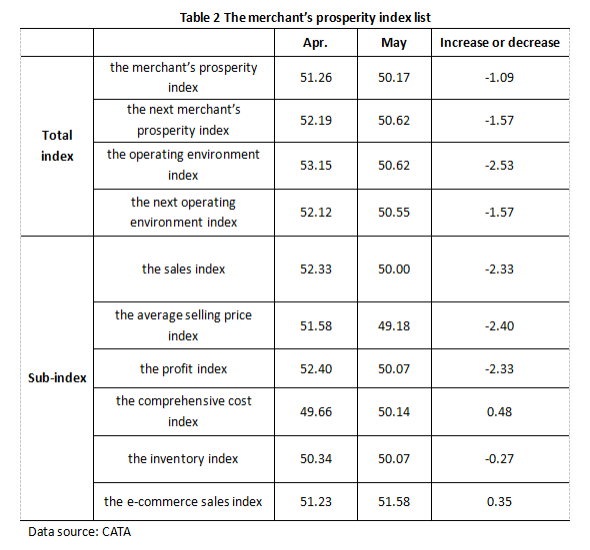

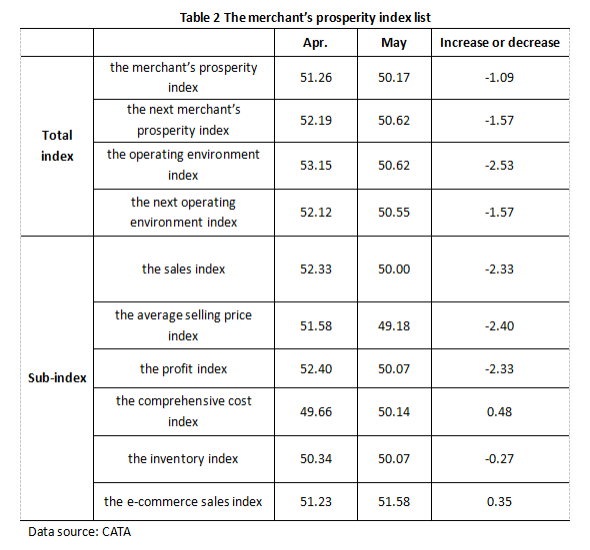

The prosperity monitoring results of the China Commercial Circulation Association of Textile and Apparel (CATA) show that in May 2021, the national textile and apparel specialized market manager’s prosperity index was 50.16, down 1.18 percentage points from 51.34 in April; the specialized market merchant’s prosperity index was 50.17, down 1.09 percentage points from 51.26 in April. In May, the textile and apparel specialized market entered the off-season, and the overall prosperity index fell.

1. The prosperity index of managers and merchants has declined

The data shows that in May, the overall prosperity indexes of managers and merchants in the national textile and apparel specialized market dropped compared with April.

1.1 The manager’s prosperity index dropped by 1.18 percentage points

2. The merchant’s prosperity index dropped by 1.09 percentage points

2. Data analysis

1. The total market operation and logistics shipment index declined

In May, the proportion of total selected market operations decreased by 16.13 percent, an increase of 16.13 percentage points from 0.00 percent in April; the proportion of selected market logistics shipments decreased by 22.58 percent, an increase of 22.58 percentage points from the 0.00 percent in April. The total market operation index and the logistics shipment index both showed a significant decline. In addition to the recurrence of the pandemic in China, the textile and apparel specialized market has entered the off-season.

2. The total sales volume and profit index of merchants declined

In May, the proportion of selected merchant’s total sales decreased was 11.64 percent, an increase of 10.96 percent from 0.68 percent in April; the proportion of selected merchant’s profit decreased was 10.96 percent, an increase of 10.28 percent from April’s 0.68 percent. Both the total sales index and profit index of merchants showed a significant decline, entering the off-season.

3. The overall prediction index is improving

The data shows that in terms of managers, the next manager’s prosperity index is 50.97, down 1.29 percentage points from 52.26 in April; the next operating environment index is 50.00, down 1.94 percentage points from 51.94 in April. In terms of merchants, the next merchant’s prosperity index is 50.62, which is 1.57 percentage points lower than that of 52.19 in April; the next operating environment index is 50.55, which is 1.57 percentage points lower than that of 52.12 in April. In terms of predictive indexes, the four predictive indexes of managers and merchants declined, but they remained above the 50 - the threshold separating contraction from expansion. It can be seen that specialized market managers and merchants still have certain confidence in June sales.