An active opportunity for the Chinese activewear market

Jun 05, 2017 | by Flora

If you think activewear makers were excited when the athleisure boom took place in the U.S., imagine how interesting the Chinese market is to them.

In the U.S., with a population of 321 million people, the activewear/athleisure market is estimated to be worth $44 billion, according to The NPD Group. While the category is expected to continue its growth trend here — Morgan Stanley forecasts it will reach $83 billion by 2020 — the American market is more mature. Everyone from Lululemon, which started the activewear-as-everyday wear trend, to high fashion designers to Target is carrying some version of it, which means the U.S. presents fewer opportunities for growth.

But the Chinese market is ripe with opportunity. At nearly 1.4 billion, that country’s population dwarfs America. It began exploring national fitness policies as far back as 1978. Following the 2008 Olympics in Beijing, then the President of the Peoples Republic of China, Hu Jintao, announced a government-backed sports-for-all fitness policy.

“Our ultimate goal is to use sport to improve people’s fitness level and improve their living standards,” Then-President Hu stated. “Sport should service the people’s all-around development and facilitate the development of the economy. Elite sport and mass sport should advance together to achieve sustainable development.”

Chinese consumers have also experienced increased disposable income. Earlier this year, official data showed China’s per capita disposable income increased 6.3 percent year-over-year, according to the National Bureau of Statistics. The year prior, the increase stood at 7.4 percent.

Between the government-backed fitness policy and the increased spending ability, China has seen an increase in workout facilities. IBISWorld’s Gym, Health & Fitness Clubs market research report shows the industry was set to generate $5.81 billion last year, an 11.8 percent annualized growth between 2011 and 2016.

All this has led to a need for more active and athleisure apparel. And in Cotton Council International (CCI) and Cotton Incorporated’s 2016 Chinese Activewear Study, research proved China represents an opportunity for cotton activewear.

The Activewear study shows consumers who buy athletic apparel work out at least three times per week. Most (63 percent) exercise 30-to-60 minutes per session; few (5 percent) exercise vigorously. Running (67 percent) and walking (57 percent) are the most common activities, followed by swimming (34 percent), aerobics (26 percent), dancing (22 percent), and hiking (22 percent).

Euromonitor International performed a Sportswear in China survey in which it found running to be increasing in popularity because “it does not require a specific field or equipment, with very low entry barriers for ordinary consumers. Meanwhile, runners can eagerly and easily share their successes via their personal social media accounts such as WeChat, to have a sense of accomplishment. The rising passion for running amongst average consumers gave rise to the rapid growth of running footwear and apparel.”

Like Americans, the Chinese don’t wear their activewear exclusively for exercise. The Activewear study shows they also wear it for running errands (40 percent), shopping (42 percent), around the house (39 percent), out to eat or a movie (33 percent), and doing yard work outside (27 percent). Nearly 6 out of 10 consumers (59 percent) choose activewear for other activities because it’s comfortable.

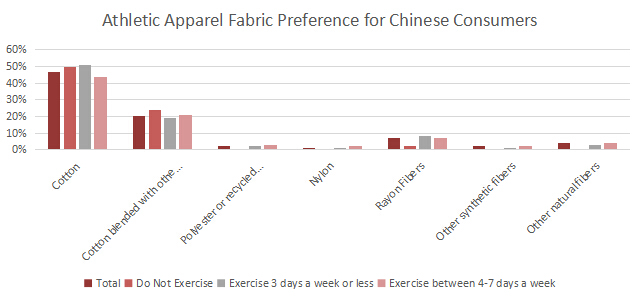

Regardless of activity preference or exercise level, cotton (47 percent) is by far the overall fabric preference for activewear, followed by cotton blends (20 percent), rayon (7 percent), and polyester (4 percent), according to the Activewear study. Further, 69 percent says it’s “the only fabric/one of the few fabrics I consider” when shopping for athletic apparel.

The Activewear study research also shows there is room for growth because Chinese consumers currently do not own a lot of activewear pieces. On average, they own 2.5 T-shirts, 2 compression or tight-fitting shirts, 2 tank tops or sleeveless shirts, 2 pairs of shorts, and 2 pairs of pants.

The Euromonitor research found athleisure is popular with younger consumers who wear it on a daily basis. “More sports-inspired apparel brands aim to enhance their brand awareness and reputation by cooperating with fashion and sports media, for instance Kappa, which partnered with popular fashion magazines such as Rayli and Vivi, and strengthened its trendy image. In addition, these brands often incorporate popular topics or elements in their products, to set trends by launching limited editions. Vans, for example, joined with Disney and introduced a ‘Toy Story’ series.”

The Activewear study finds Nike (26 percent) and Adidas (20 percent) are the top activewear brands purchased in China by all consumers, whether they’re light or heavy exercisers, or even if they don’t exercise at all. That’s followed by Li-Ning (16 percent), Anta (10 percent), 361 (7 percent), Xtep (4 percent), and Qiaodan (2 percent).

This shows the power of Western influence in China’s the active/athleisure categories. Normally, Chinese consumers prefer Chinese brands. Prosper Insights & Analytics found that generally, Chinese brands are preferred by 68 percent of consumers. That compares to 26 percent who seek U.S. brands, 20 percent who prefer Korean styles, 18 percent who look for European labels, and 13 percent who buy Japanese brands.

Nike and Adidas benefit from having the foresight and economic ability to invest in the region. Nike teamed with the Chinese Ministry of Education on a three-year schools sports plan. And Adidas hired Chinese actress Zhang Jun Ning as an ambassador.

More than 4 of 10 Chinese consumers (41 percent) say celebrity endorsements are “somewhat influential,” according to the Activewear study. But peers really impact purchases, as the survey found that half of those who exercise 4-to-7 days a week are asked “somewhat frequently” (42 percent) or “frequently” (8 percent) for activewear advice.

“With the rising enthusiasm for sports activities, more local consumers are engaged in various forms of physical exercise to keep fit amidst the accelerating pace of life and mounting pressures from life and work, especially amongst white collar workers,” the Euromonitor informs. “Sportswear [an aggregation of performance, outdoor and sports-inspired clothing and footwear] is the best clothing for these occasions.”